Computers

Many traders who started trading more than five years ago, never knew what a computer was, let alone what it could do! Most traders used brokers to do everything, including checking prices by phone or fax. Before computers, all charting was done by hand on paper charts, and updated manually everyday.

Imagine the time it took to calculate all of the indicators formulas and to enter them on the chart!

Now, with technology so much has changed! You can check prices on-line anywhere at anytime, analyze charts with the click of a few buttons that can run complicated mathematical equations in the blink of an eye. All of this technology, not only allows you to analyze the markets in so much more detail, but to also allow you to analyze so many more markets in the same amount of time, exposing a number of potential trading opportunities that would have gone unnoticed in the past.

Charting Software

There are dozens upon dozens of charting software programs on the market. Some range from free and the high-end programs can go as high as $5,000 or more. Like in most things in life, you usually get what you pay for.

I’m not going to get into a big discussion on all the different programs out there. Try the free charting software that came with this course. It’s not as high end as say Trade Station but then again, it doesn’t cost $2,000 either. It’s a good starting point for most people and many people will find this is all they will ever need.

All the charts you have seen in this course were produced with my own charting software, Track n’ Trade Pro from Gecko Software.

Commitment of Traders Report

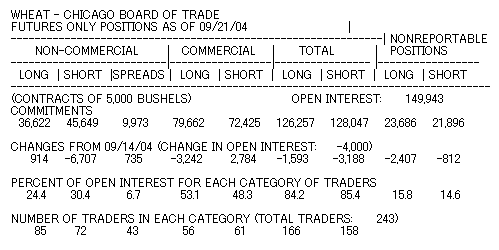

The COT is another tool you can use in your market analysis. This report is weekly and published every two weeks so it’s “late” by the time you get it. What this report does is to breakdown the Open Interest figures of the three categories of traders; Small Speculators, Large Speculators, and the Commercials (companies who actually take delivery of the commodities).

Many people feel that the Commercials are the “smart money” in the markets because they are better informed and the Small Speculators are less informed, and I tend to agree.

I would suggest that you try to follow the Commercials and not the Small or Large Specs. The Commercials are usually right in the long term.

You can see in the chart below what the overall consensus is. It’s interesting to note that the Commercials are “net long” (they have more long positions than short positions) yet the Small and Large Specs are “net short”.

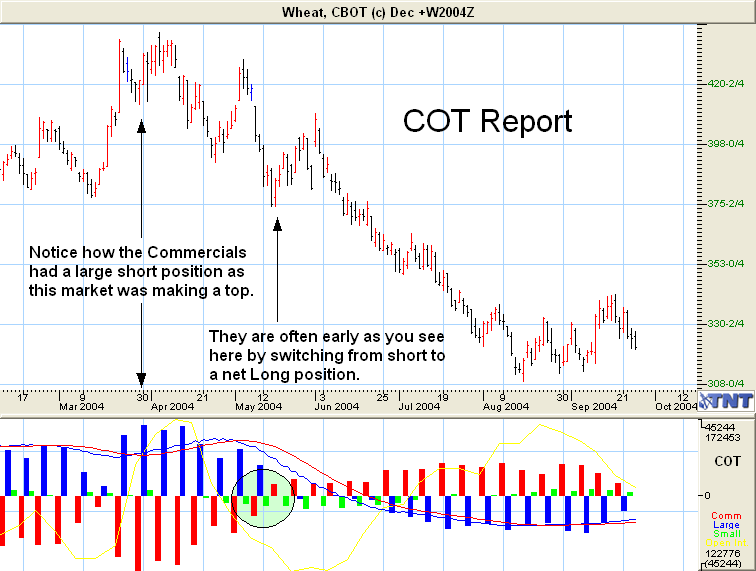

Look at the following chart for December 2004 CBOT Wheat so you can see what the report relates to. Notice that the COT report is from September 21, 2004. Currently the Commercials are net long at this market is bottoming. If you are short this market and you see the Commercials building up a long position, you might ask yourself why.

Now also keep in mind that the Commercials have very deep pockets and are “early” in the markets. This just means they have the staying power most Small and Large Specs don’t have. So, keep that in mind when looking at this report.

You can get this report for free on the internet. Look on the TTC Links page to find the link. Also as you can see from the chart above, Gecko Software has now included this report right into the Track ‘N’ Trade Pro.

Money Management

Let me start out by saying that if you don’t have a plan for managing your money, you will go broke. Read that again!

I know that many people just love to trade for the sake of trading. They like the excitement the markets offer. They like the upside potential that’s always there. They seem to have to trade something, just anything, in order to feel like they are “in” the markets. This is definitely the formula for failure.

This lesson should probably have been lesson #1 instead of lesson #9, but I thought I would save it until now. It is the most important lesson in this course.

I want to give you some rules to begin with, and I hope you take them to heart.

Rule #1 Always use a stop loss.

Rule #2 Don’t over trade

Rule #3 Don’t chase the markets

Rule #4 Never answer a margin call (don’t be wrong twice)

Rule #5 Learn twice as much from your mistakes as you do from your successes.

Rule #6 Treat your trading like a business. This is crucial!

Rule #7 Don’t listen to everyone else, make your own decisions.

Rule #8 Losses are part of the game.

Rule #9 Do your homework before you trade, not after.

Rule #10 See Rule #1

Now that I’ve given you a few rules, some of which I’ve learned firsthand, I want to give you some general guidelines to trade by. These of course are not set in stone and that’s why they are called guidelines, except for Rule #1.

- How much of my trading account should be at risk? A good rule of thumb is 50%. In other words you should never be trading with more than 50% of your capital at risk. The other 50% should be in Treasury Bills. As an example, if you have a $10,000 account you should never have more than $5,000 at risk at any time.

- Commitment to any one market should not be more than about 10% to 15% of your trading account. Example, if you are trading the grains then you should not have more than $1,000 to $1,500 at risk in grains at any one time.

- You should never invest more than 5% into any one commodity. So a $10,000 account should not risk more than $500 on a single trade. I know that is going to keep you out of some trades you want to make. My objective is to keep you in the game, not out of the market. You might have to start with options rather than futures.

- You should never trade the thin markets, period! At a bare minimum, you should trade markets with at least a daily volume of 1,000 and open interest of at least 5,000.

- Always use a stop loss for protection. Only a fool trades without one. The more volatile the market, the wider your stops must be and the more risk you must incur.

- The world’s best traders only make a profit on about 40% of their trades! Well, if that’s the case, how do even the best traders make money? What they do is make sure that the winning trades make more money than the losing trades. Remember that we talked about Risk/Reward Ratios earlier in the course.

- Add to your winners and cut your losses. Since only a handful of your trades will generate huge returns, it’s necessary to take advantage of those big winners. You do that by adding to your winners. We talked about that earlier in the course if you recall. Add to your winners at predetermined price points. Remember the example where we talked about pillaring?

Get rich quick? I can’t tell you how many people I talk to that think they are going to get rich quick from trading. I’ll never forget a call I got one day when this guy asked me if our “system” would allow him to make $100,000 in the next 6 months with a $5,000 account! I told him that anyone could get lucky and do that but his chance of doing it is probably 10,000 to 1. He said he was going to buy someone else’s course because they told him that he could make this much money easily with their “system”. I almost laughed out loud but didn’t and wished him the best of luck.

Trading is not a get rich quick game. At best, it’s a get rich slow game. So many people want to know how long it’s going to take them to trade full time.

If someone came to you today and said that if you would work part-time, an hour or two a day for the next five years and at the end of five years, you could quit your job, continue working a couple of hours a day and have the same or better lifestyle, would you do it?

Smaller accounts can grow faster than larger accounts. It’s much easier to make 100% return on a $10,000 account than it is on a $1,000,000 account. It’s just one of the laws of the universe. With that in mind, let’s take the approach that you can make 100% a year on your money trading.

So you want to figure out how long it’s going to take you to trade full time. First, how much is your current income that you want to replace? Let’s use $100,000 for example. Let’s also say that you have a $10,000 account to start with. Now obviously if you want to make $100,000 a year trading and you can make 100% a year on your money, then you need to have an account of $100,000. How long will it take you to get there? You do the math and see.

Streaks

Everyone goes through winning streaks as well as losing streaks. You must learn to handle both of them. Let’s say that your trading account is down by 50% after a series of losing trades. What do you do? No, the answer is not to through in the towel! The challenge you have here is that you now must double your account just to get back to zero. And yes, I’ve been there in case you were wondering, as have many other traders. So if this has happened to you or is happening to you right now, at least you can say you are in good company.

What do you do though is the question. What I would do right away is “go flat” or get completely out of the markets because something is wrong. Either you don’t know what you are doing, the markets are not acting properly, or you are getting careless. Whatever it is, don’t continue right now.

Someone told me once that the definition of insanity is to continue doing the same thing over and over but expect different results.

I would then go back and look at each trade again. Study them. Was it the markets that were just “misbehaving” or was it you. Were you careless?

What went wrong? Why? Were your targets correct? Were your stops correct? Too close together or too far apart? Like I said, you should learn twice as much from your mistakes as from your successes.

Now that you have done this, it’s time to get back into the markets but what’s the best way to approach it? Well, that depends on what the problem was. If it was just the markets acting up and it wasn’t something you did, then continue doing what you were doing. It should turn around for you. On the other hand, if it was something that you were doing wrong, make sure you correct it before you get back into the market.

If it was you who was at fault, not trading correctly, then I would enter the markets slowly with maybe one or two contracts that have been completely studied. It’s not the time to get conservative on your trades, just time to get “correct” again on your trades. Build up your confidence and at the same time, build up your account. Consider this as part of your educational cost.

Conversely, you may be going through a winning streak. What do you do now? That’s the worst time to “double up” on your trades and try to make a killing. It would be like going to Las Vegas and each time you win, you double the next bet. You will lose that way. It’s guaranteed and it’s the same in trading.

It’s just like the old saying about a watch. If it works don’t fix it. You should however keep on with your plan that I outlined above, 10% at risk, etc. Just by the increase in your account size, you will be adding to the size of your positions. Develop your own trading plan and stick with it! It’s ok to adjust it, just don’t change it especially if it’s working. You must become disciplined!

There is a good book that you might want to read. As a matter of fact, I highly recommend it. The name of the book is “The Trading Game” written by Ryan Jones. It should be part of every trader’s library. We will discuss this more in the final lesson too.

Trading Journal

This is the most important tool in your trading arsenal! If you didn’t get that, read it again and again until you do. You must keep an accurate and up-to-date trading journal. I have included one for you at the end of this lesson and if you don’t like the way I have set this one up do your own. But you must enter every trade you do.

On each trade I do, I not only keep the journal, I also keep the charts that I did my analysis of the trade. Print multiple charts if you need to. One with RSI, one with Moving Averages, one with Trend Lines, etc. Then each week that you are in the trade, update the chart and study it, just like if you were making a new trade. Think of it like you were making a new trade in the same direction. Would you do it? If not, is it time to exit the trade?

Think! Study! Plan!

Journal Checklist: When you are doing your analysis, you should have a checklist and go through it on each trade you make. Read that again! I said each trade you make you must go through the outline. Below, I’ve got one that I use. If you like it, use it, or make your own. The bottom line is that you must use a checklist on each trade. Don’t vary. Become disciplined!

Before The Trade

- What are the Weekly and Monthly charts showing?

- Draw in the Trendlines.

- What direction are the Major, Minor, and Current trends?

- Mark the support and resistance levels.

- Mark the Common Numbers if any.

- Am I looking at the correct month per Volume and Open Interest?

- How long do I have before the contract expires? At least 30 days?

- At what price are the 38.2%, 50%, 61.8% retracement levels?

- Are the any Gaps that should fill?

- If there are any patterns developing, are they continuation or reversal patterns?

- Where is the Daily, Weekly, and Monthly 50% level?

- Where is the next 50% retracement that should take place?

- What are the Oscillators showing? Overbought? Oversold? Are there any Divergences?

- Are the moving averages pointed up or down?

- Will I buy or sell this market?

- What is my Risk/Reward Ratio? Is it at least 3:1?

- Where will I enter this market?

- Where will my protective stop be?

- Where is my profit target?

- Where will I add-on to my position?

- How many contracts can I trade?

- What type of order will I use?

- Why am I making this trade?

After The Trade is Over

- Profit/Loss on the trade after I exit.

- What did I do right?

- What did I do wrong, if anything?

- What can I learn from this trade?

Trading Journal

Remember the trend is your friend

Brokers Name:______________ Date:________

Commodity______________ Contract Month:_ # Contracts___

Profit Target: Risk/Reward Ratio:__ 3:1 or better?_ Initial Stop Loss is at:____ Reason:_______________

Order Type _______ Filled at:_ Long or Short__

FND:___ LTD:____ Exit Trade By___________

50% Levels: Monthly___________ Weekly____________ Daily___________ Major_____________ Minor_____________

Fibonacci Retracements Are: _ / __ / _

Support & Resistance Levels: / _ / _ / _ / __

RSI is at: __ MACD: __ MA Crossed?

Oversold or Overbought? ___ Trading with the trend? _

Stop Moved to & Date Targets Moved to & Date

__ / ___ /___

/_ __ / ___

/ _ __ / ___

_ / ____ __ / ___

Exited Trade At: ________ Reason: __________

Profit/Loss – In Points ___ In Dollars $____________________ Days in the Trade __

Journal Notes

Date: _ Price: _ Profit/Loss Pts & $ /$___

Comments:_________________________________________________________________________________________________________

Date: _ Price: _ Profit/Loss Pts & $ /$___

Comments:_________________________________________________________________________________________________________

Date: _ Price: _ Profit/Loss Pts & $ /$___

Comments:_________________________________________________________________________________________________________

Date: _ Price: _ Profit/Loss Pts & $ /$___

Comments:_________________________________________________________________________________________________________

Date: _ Price: _ Profit/Loss Pts & $ /$___

Comments:_________________________________________________________________________________________________________

Date: _ Price: _ Profit/Loss Pts & $ /$___

Comments:_________________________________________________________________________________________________________

What I did Right/Wrong:_______________________________

What I learned from this:_______________________________

Finding The Right Broker

Many people seem to have a challenge with this, and I know I did when I first started. I didn’t know what a good broker should or should not do, and I had no way to compare them.

Let me list a few things that might be helpful:

Ask lots of Questions: You are paying for something here! Would you go out and spend several thousand dollars on something and not even ask a question to the person you are paying? I hope not! I often pay well over $2,000 a month in commissions so you can bet that I’m going to ask any question that I want to. And I’d better get a good answer too.

Some good questions to ask are:

- How long has your firm been in business?

- How long have you been a broker?

- What free services and support do I get?

- What hours are you open?

- Who is clearing your firm?

- What is your commission rate?

- What “add-on fees” if any do you charge in addition to the commissions?

- Is there a monthly fee charged?

- What is your minimum account size?

- Will they paper trade with you without opening an account?

- Ask if they trade their own account. Many do not!

Commissions

When you first start trading, you will probably want to go with a full service broker. I’ve been trading fro years and I still use a full service broker. I want the second set of eyes looking at what I’m doing. I’ve seen brokers that charge as much as $200 a round turn (both sides of a trade). These people should be shot as they are just taking advantage of people who don’t know.

What’s fair? That depends on a lot of things. I think $50 for a new person that is not trading a lot is reasonable for single orders. Multiple contracts at the same time should get a discount. Remember, it doesn’t take any longer for them to buy four contracts as it does one contract.

Keep in mind that your broker has to make a living too. Don’t expect to get huge discounts if you are placing one order a week. It just won’t happen.

If you don’t like your broker but like the firm, change brokers, not firms!

Just make sure you have a good feeling from this person. Are they really trying to help you? Also let them know that you will be making your own decisions and not to call you everyday with trading “advice”. Be strong about this point!