You are about to learn the complete details of a trading strategy we are using to trade in the FX, Futures, Stock, Indexes, Bonds Markets. Each market has its unique approach with this strategy, but the rules stay the same no matter what. This strategy can be traded in any market where a price chart is available. Our focus is on Elliott Wave patterns for opportunities.

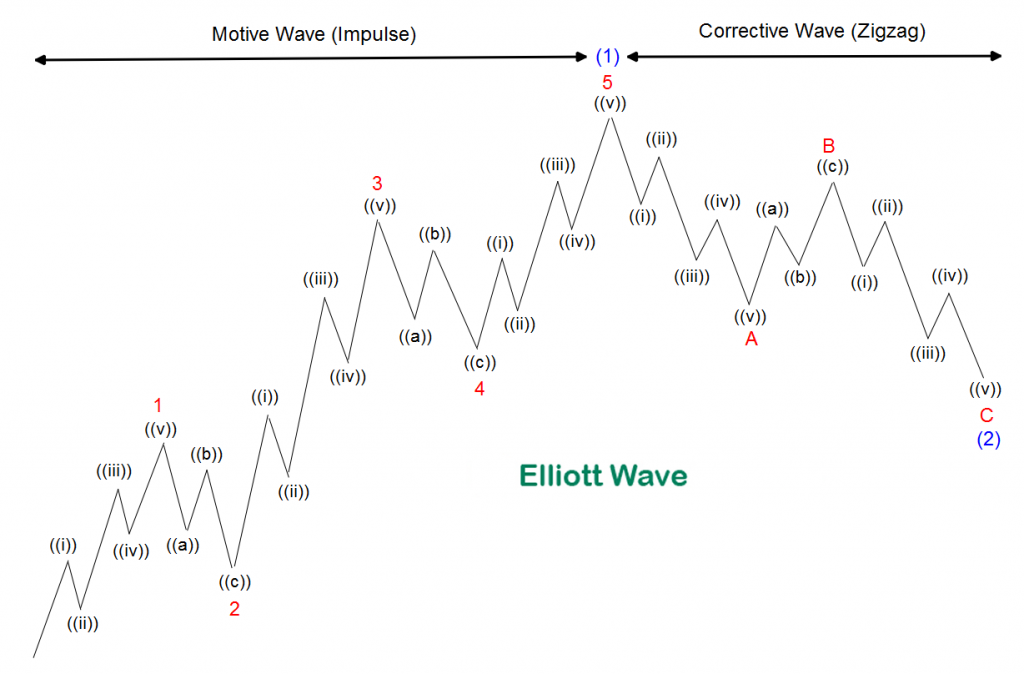

Elliott Wave Theory was developed by R.N. Elliott and advanced by Robert Prechter. Elliott Identified a certain structure to price movement which sets out a basic 5-wave impulse sequence and 3-wave corrective sequence. there are degrees of a wave from Grand Super Cycle down to the subminuette with most charts focusing on 3 of the 9 degrees on their charts. This discovery has far-reaching implications, and being able to chart waves consistently will give you an edge in your trading. It is also debated to be the mathematics of sociology. However, there are usually multiple interpretations that should always be kept in mind, and you will know when your count is wrong or one interpretation will dominate over the others.

Basic Elliott Wave Structure

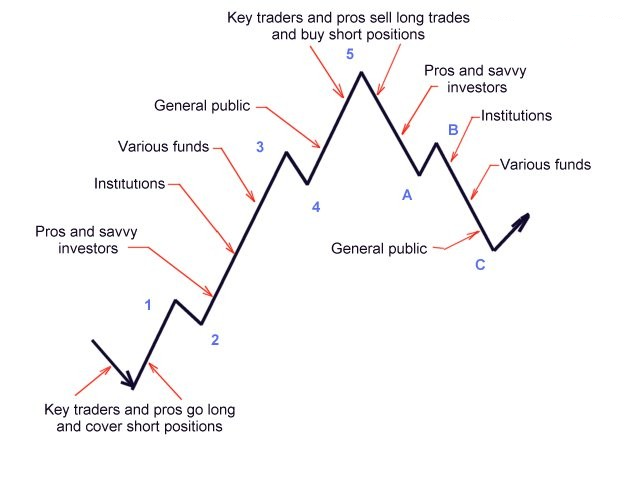

Waves reflect the psychology, sentiment of the crowd. Different investors create the various wave actions.

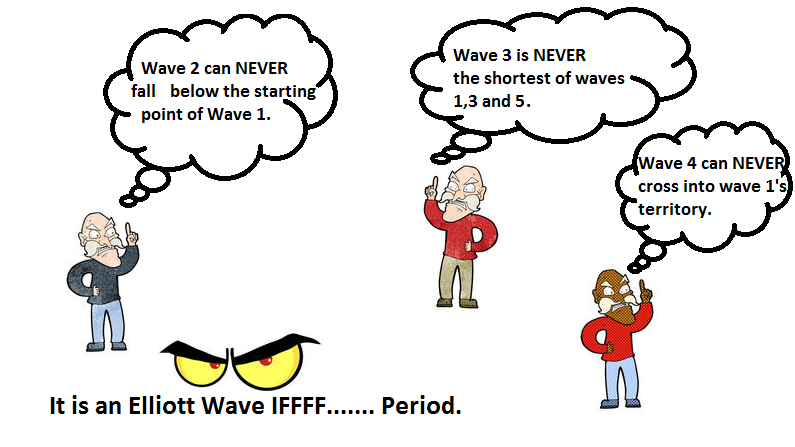

The Rules are Simple!

The Elliott Wave Principle

By Robert Prechter

Elliott Wave is one form of technical analysis used to analyze the market structure. It takes dedication and a lot of practice to develop the skills for counting waves. A good start to learning Elliott Wave Analysis is Robert Prechter’s book The Elliott Wave Principle. It is the most useful and comprehensive guide to understanding and applying the Wave Principle.

Until you have a good grasp of it, the counts will be provided by the team leader and those traders who have become wavers.

We are using the EWPT strategy to swing trade in the FX markets.

Swing trading, unlike position trading, anticipates the market’s next move. Trading opportunities present themselves on both the long and short side, regardless of the underlying long-term trend. Our main goal is to minimize risk and protecting profits as they are made.

A trading plan is made up of 5 essential elements. There are debates as to which one is the most important but we believe they are all critical parts to the overall trade. Your mindset is above all the most difficult part to train and we are confident that working with Crush Pro Teams will help you develop it.

Trading Plan

1.The Setup: Identify and analyze opportunities

2. Entry: How to get into the market

3. Exits: How to get out of the market when you are right or wrong

4. Risk Management: Is the opportunity worth the risk?

5. Money Management: How to grow your capital

Developing a Trader’s mindset throughout

Each part of the trading plan will contain exactly what must be done in order to successfully trade this strategy. Conditions must be met (the rules) for each part of the plan. This will allow you to be able to repeat the process.

Emotions will be a hindrance in your development, and whether or not you can control them is critical. We have taken steps that will help, but only you can decide to follow the rules and guidelines. If done properly you will see your account grow, it is up to you.

Trader’s Mindset:

What is an edge? It is defined as any technique, observation, or approach that creates a cash advantage over other market players. Do you really need to have an advantage over other traders or just be in tune with the professional traders? An edge is what puts the probability of winning in your favor. Winning a trade is easy, but in order to win consistently you must develop a trader’s mindset. So, an edge to us is working hard to gain the confidence to execute our method without hesitation or fear. Everything else is up to the market.