The 2% Rule is a fixed fractional Money Management Strategy and it is an anti-martingale approach that is especially good for beginning traders. So if you are new to “Live” trading then we highly recommend you start here. The strategy is simple, you take 2% of your account balance and that is going to determine your position size for each trade.

A Fixed Fractional method is also good if you are trading a larger account, say over a million. Once you have reached that milestone, then reducing risk becomes more important and you don’t have to take as much risk and still make more than enough money to continue to grow your account and have the lifestyle that you desire.

As we demonstrated in the Introduction to Money Management video, the 2% Rule method is more risk orientated than growth orientated, but it is a good method to use until you gain confidence in your trading, or if you are a more risk adverse type of trader. You can even drop down to 1% for a while and get a feel for the different risk percentages and how your account grows.

Pay special attention to how you feel about the size of risk and how your account is increasing and decreasing due to drawdowns. This will give you a good idea about your risk tolerance.

Let’s look at an example

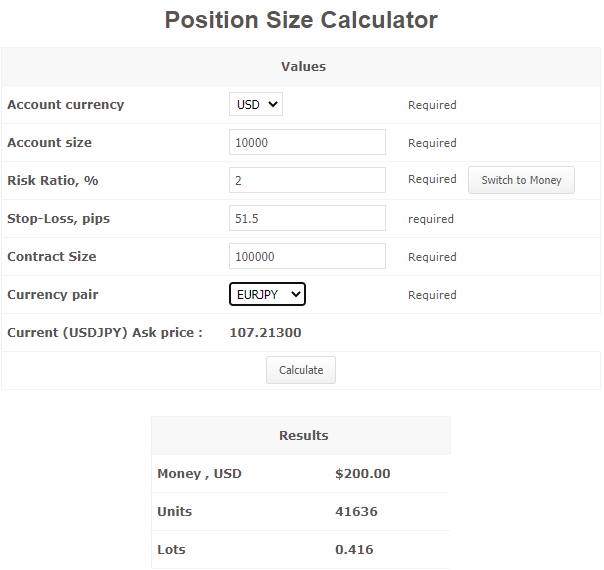

Let say you are looking to enter a buy trade in the EURJPY market and you have set up the trade with your entry at 117.23, stop loss at 116.72 and profit target at 117.75. Your total risk on the trade is 51.5 pips. This is your very first live trade and your account size is $10,000. You pull up a Position Size Calculator, there are many so find one you like online. Click on the image below to use the calculator.

Account Currency

Since your base currency is USD, leave the account currency at the default setting. If you are trading with a different currency as your base then you will change it to that currency.

Account Size

Here you enter the size of your trading account. In our example it is $10,000. Since this is our first trade we don’t have any open positions. If you did then you should use the account balance prior to any open trades you currently have. This will ensure that you are not using any profits that haven’t been realized yet.

Risk Percentage

Enter 2 which represents 2% risk of your account balance for this trade. If you are trading a different percentage like 1% then enter that instead.

Stop-Loss (pips)

Enter the risk for the trade in pips. In our example R = 51.5 pips so enter that here.

Currency Pair

Select the currency pair your trade is for such as EURJPY in our example.

Once you have entered all the numbers, click “Calculate” and the results will show Money, USD $200 which is the amount you intend to risk on the trade, and Lots 0.416, the position size for the trade. 1.0 is a standard lot and .10 is a mini lot so we are going to trade 4.2 mini lots.

Be sure to understand your broker and how to enter trades as it differs depending on the platform used and whether you have a standard account or something else. When trading with MT4 you can enter the size directly into the platform. If you are trading 2 positions, then divide the lots by 2. In this example we would set up 2 buy positions for .21 lots each.

Trading presents us with a fundamental paradox: How do we remain disciplined, focused, and confident in the face of constant uncertainty? When you have learned to “think” like a trader, that’s exactly what you’ll be able to do. Learning how to redefine your trading activities in a way that allows you to completely accept risk is key to thinking like a successful trader.

Mark Douglas