Many of your trades will not be 123 Tops or 123 Bottoms, Channels, or any other specific formation. Remember, I said earlier that “The Trend Is Your Friend”? Well, if there is not a breakout of a trend line, a Channel, or another formation developing at that time and you want to enter the market, just where do you get in? In the middle of the trend, that’s where!

The safest trades you can make are the ones when you are trading in the direction of the current trend. In other words, if the trend is up, you should be long and if the trend is down, you should be short. It doesn’t take a rocket scientist to figure this out, but what exactly is the current trend; is it trending up or down?

An uptrend, is a series of days that have higher highs, while at the same time, have higher lows. A downtrend is just the opposite, a series of lower lows and lower highs.

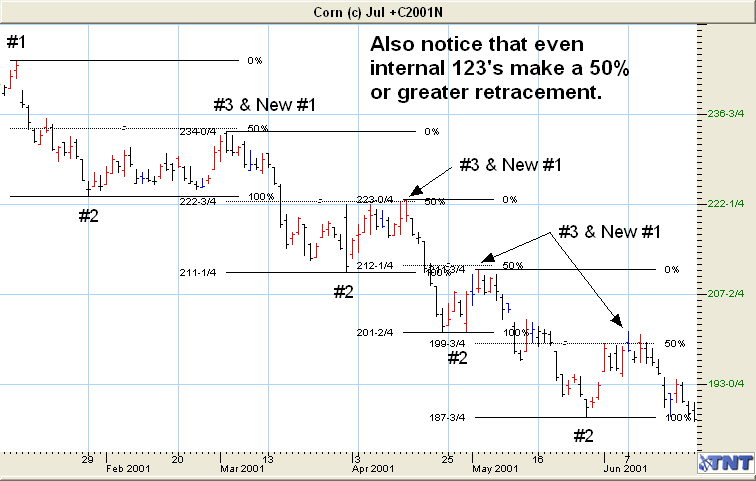

Using internal 123’s To Confirm The Trend

As you can see in the chart on the following page, the trend is definitely down. This downtrend is a series of internal 123’s. We can confirm this downtrend by labeling each new 123 with a 1, 2 or 3. Notice that the first set is in the upper left hand corner and represented a trend reversal. The second set of internal 123’s continues to confirm the downtrend, as did the third, fourth, and fifth sets.

Notice that each #3 point also becomes a new #1 point for the next internal 123 formation. Keep in mind the 50% retracement rule, as it works equally well here.

If you missed the start of this trend and wanted to enter a trade in the middle of it, you would want to get in at the best price. You could, and still make sure that when you did get in that the trend was still continuing. One way that you could do this is to wait until a new 123 was being formed and then place an alert with your broker or system to notify you so you could go short just below the next #2 point when it is formed.

An alternative way would be to wait until the #2 point did a 50% retracement towards the #1 point (thus forming a #3 point), and enter the market to go short, when the #3 point reversed direction. The upside of doing this is that you will enter the market at a better price; the downside is that you may enter the market at the wrong time and in the wrong direction.

By its very nature, when the #3 point is formed, it also becomes a new #1 point.

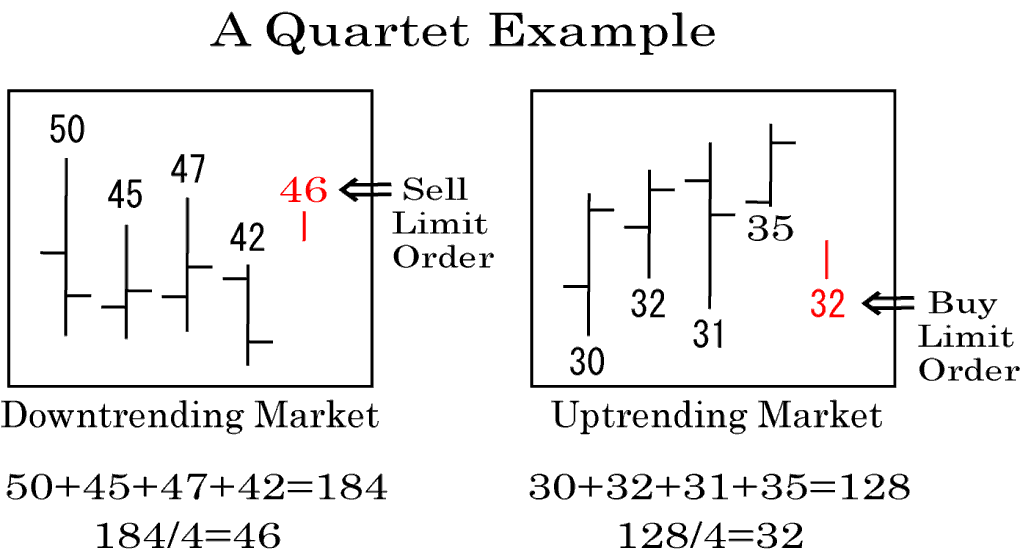

A Quartet

This only works in an established uptrend or an established downtrend. Do not use it at any other time. This is another method of entering a trending market. This can also be called a “Four Day Box”.

During a downtrending market you would take the highs of the last four trading days and add them together and then divide the total by four. This gives you the average of the last four day’s highs. You would then place a limit order to go short for the next trading day at this average price. In this case you would not use an alert, but a limit order as a day order only, not a GTC order.

During an uptrending market you would take the lows of the last four trading days and add them together and then divide the total by four. This gives you the average of the last four day’s lows. You would then place a limit order, long, for the next trading day at this average price. You will be surprised how well this works and how accurate it is. Go back on some of the past charts and see how this might have worked.

Always Be Odd

I’ve learned that it’s best to be odd with your stops. What I mean by that, is when you place a stop loss, don’t place it exactly at an even number like 250 or 250.50. Place it just above or just below these even prices. Rather, use a stop like 250.33 or 249.41. The reason is that prices seem to go to a specific even number rather than an odd number and stop.

Also, never place your stop at the exact support or resistance level. Many times, prices will head straight towards a specific support or resistance level, touch it and then reverse direction again. This would stop you out prematurely. (Remember Double & Triple Tops & Bottoms?)

By placing your stops just above or just below you might have a little extra risk on the trade but that’s okay because I’d rather you take a little extra risk than to keep getting stopped out with a loss.

Also, be sure to tell your broker that you want a stop that is GTC (Good Till Cancelled). If you don’t, he/she might think that you just want to have that stop for one day only and the next day this stop would be cancelled and you would not have any stop loss in place – very dangerous. You would have to call in/ place a new stop each day unless you placed a GTC order.

We are going to cover the proper placement of stops later in the course in greater detail, but for now, just remember to be “odd” with your stops. Remember The Even Number Phenomena in Lesson Three?

Taking Profits

This is going to be one of the most difficult things that you will have to learn. It sounds easy; just take the money and run. But it’s not as easy as it sounds, because emotions come into play and it can be gut wrenching.

This will be much easier if you have set your profit-taking targets in advance. By having predetermined targets, you know when to take profits and when to exit the trade. Sure, you are going to leave money on the table sometimes because the price hit your target and you got out and then the price continued in the same direction and you did not make the “extra” money you would have if you had stayed in the trade. That’s fine; it’s part of trading. Don’t get tied up in worrying how much money you could have made if you had stayed in the trade, but focus on the fact that the trade was profitable.

Have I ever taken profits early? You bet I have. When I see a lot of money on the table, I get greedy sometimes and take it. Is that wrong? Well, one saying goes, “ you can’t lose money taking profits”, whether it is accurate or not is debatable, however the mindset is correct for this situation.

Now, the question remains, should I have done this or should I have waited until the price hit my target? The correct answer is that I should have waited, but I’m human just like you and don’t always make the correct decisions.

Cut Your Losses & Add To Your Winners

Never stay in a losing trade trying to “get even” with the market.

Never, never, never add to a losing trade to try and average out your price. This is the surest way to financial ruin that I know of. That’s why we have stops. Use them! When you enter a trade, you should have already done your homework and have several things planned in advance. They are:

- Your Risk/Reward Ratio

- Your Entry Price

- Your Initial Stop Loss Price

- Your Profit Targets

- Your Add on Targets

The first three items in the list we have already discussed, but the last two are new for you and we will discuss those later in this lesson.

There are only two hard and fast rules that you need to learn.

- Cut your Losses

- Add to your winners

If you don’t add to your winners, you won’t ever be successful. The reason is that you will probably have more losing trades than you have winning trades. It’s all part of trading. You have to add to your winning trades to make the really big money. Any successful trader will tell you the same thing. The key is to keep your losses small and always add to your winners.

The question is, how do you add to your winners? The answer is simple. When you are making money on a trade and it’s going in your direction, you add to it at specific, predetermined, price or profit points.

There are two schools of thought on this; Pyramiding and Pillaring. I want to give you an example of each method.

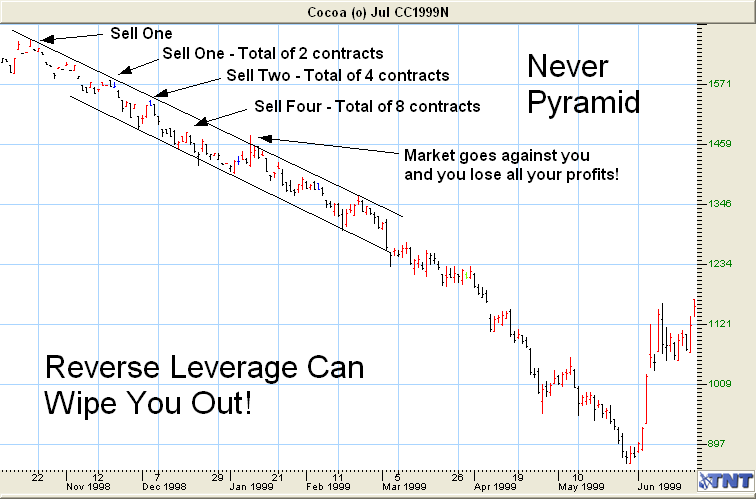

Pyramiding – The Wrong Way To Add To Your Winners

Let’s say that in the following example in Cocoa you pyramided all the way down from the top of the Channel. I’ll explain what I mean. Look at the following chart.

On your first contract you made $1,000 profit and added another one. Now you have two. Those two made another $1,000 each, now you added two more from your profits, so you have four contracts. You have spent all your profits so far, just adding new contracts.

Now you do it one more time. Your 4 contracts made $1,000 each (you’re $4,000 ahead at this point) so you add 4 more from your profits, giving you a total of 8 contracts. But tomorrow the market turns around and goes against you, and you lose $500 on each one. You just lost all your profits in one day! (Reverse Leverage – 32 times $500 X 8 contracts = $4,000)! Then to top it off, your broker calls you and tells you that you have a margin call of $500 on each of the 8 contracts and to send him another $4,000 if you want to stay in the trade!

Talk about a bad day! Let’s look at a better method of adding to your positions where you can keep your profits.

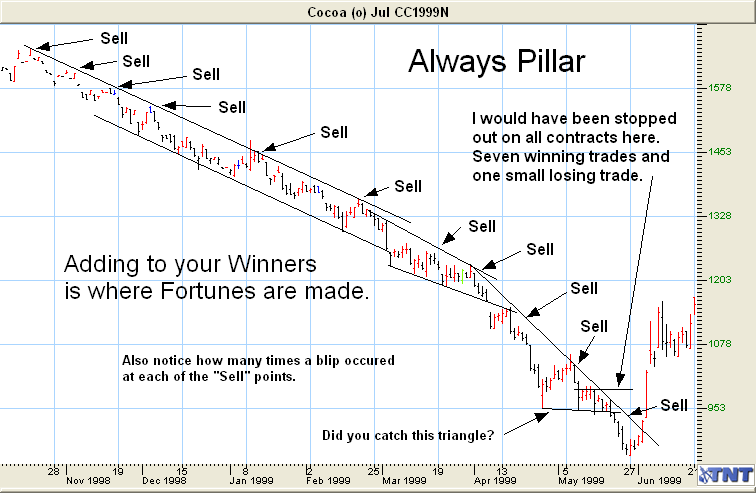

Pillaring – The Correct Way To Add To Your Winners

Using the same Cocoa contract, I’ll show you how to make a profit and keep it too. Here’s how you do it. Let’s look at the chart below. Follow this example closely.

Remember, I said to add to your winners at predetermined points? In the example above, I drew a Descending Channel down from around the 1700 level, and you can see how the channels moves down through this downtrend. I would have continued drawing this line all the way off the chart, even though the “future” dates had not taken place yet.

Once that trendline was drawn and the price continued to channel down, I would have sold (gone short) another contract each time the price “hit” the top of the trendline but did not go through it and head back down. This is one of the best ways to add to your winners; at predetermined price points. All I did was to add one contract to go short, when the price came up and touched the trendline and went down again. It’s that simple.

Each time I sold another contract, I moved ALL of the stops on the previous order down. So, all my stops are ALWAYS in the same place. This way if I get stopped out, I get stopped out on all of them at the same time.

Always keep moving ALL your stops down to lock in your profits.

So, when I did get stopped out (from all the contracts at the same time) I was able to keep most of my profits, not lose all the profits! Also see Trailing Stops in Lesson Seven to lock in profits.

Using Alerts Rather Than Open Orders

Most of the time, I will use an alert when I’m looking for the price to jump out of a Channel, break a certain support or resistance level, cross over a trend line, etc.

An alert is when you instruct your broker to notify you when a price reaches a certain point, rather than he/she executing an order at that price. Most online trading platforms come with price alerts. That way you can make a decision about what you would like to do without an order actually being executed.

As an example, when I’m trading Triangles, waiting for a breakout of a Trading Range, or a Channel, I will use an alert. That way, at least I know where the market is and I can then decide what to do.

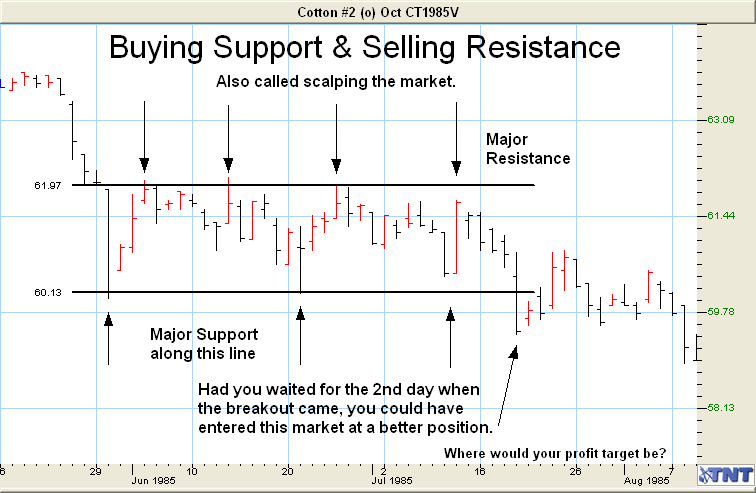

Buying Support & Selling Resistance

Many times, you can make good money trading off the support and resistance levels of the charts. You may not find a formation at the time you want to trade a certain commodity or instrument, but you can still trade it based on “buying on support” and “selling on resistance.” Let’s take a look at an example on the following chart.

You can see on the chart above that the price came up and touched the resistance line seven times. Do you think that might be a strong resistance level at this line? Of course it is. Also, look at the support on the line below it. This is just a big Trading Range that you learned about earlier.

The question is, how could you trade it? The way that I would trade it, is when the price hit the resistance line the third time, I would go short. I would take profits once the price hit the support line. Then I would re-enter short after the breakout occurred in July.

You can also use Blips to know when to exit a trade.

Slippage

Slippage is simply the difference between where you placed your order and where your order was actually filled. Prices move every trading hour; actually every minute throughout the day.

Let’s say that you want to “jump in” and go long at the current price at 50, for example. You call your broker and ask what the price is now and he says it’s at 50.25, so you tell him to buy a contract “at market”. At market means to buy it at whatever the current price may be. Sometimes it takes a few minutes, or longer in some cases, depending on the volume being traded, for your order to be filled.

Your Broker may tell you that you were filled at 50.75. Why the difference? Because by the time your order was filled, the market had moved up a few points causing you to lose some potential profits you would have made if your order had been filled at 50. Sometimes it works to your advantage and your order is filled at a better price. (In markets such as Forex with direct online ordering you can avoid much of the old school problems with slippage).

You can avoid most slippage by placing “Limit Orders”. This means that you would call your Broker and place an order to buy at 50 or better and your order would not be filled unless it was filled at 50 or lower, since you were long. We discussed these types of orders in Lesson Two.

Limit Orders sound like the perfect way to place orders, but not always. Let’s say in the first example above that you place a limit order at 50 to go long and by the time your order was on the floor to be filled the price had jumped above 50 before your order was filled. In this case your order would have never been filled and you would have missed the trade.

So, sometimes it’s best to use limit orders and sometimes it’s best to use a market order. More often than not, I use Limit Orders or Buy/Stop or Sell/Stop to try and minimize slippage and to make sure the market is doing what I think it should before my order gets filled.

Which Commodity & Contract Month Do You Trade?

Which contracts, as well as how many you should trade depend on several factors. The size of your account is the first factor you must consider. Obviously, if you only have a $5,000 account, you can’t trade the S&P 500 that has a margin of $29,000.

For small accounts under $5,000, you should trade the commodities with a small margin requirement, grains and some of the meats for example. Or you can start with a Mini Account trading Forex, which has very low requirements. See the reference section or check the website for a complete list of all the commodities and the margins required for each.

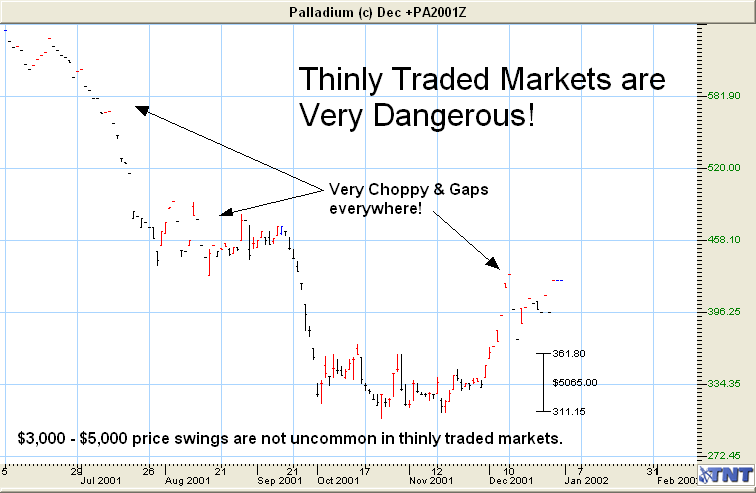

Also, stay with contracts that have a large amount of open interest and that trade a large number of daily contracts. For example, markets that have at least 1,000 contracts being traded daily and 5,000 contracts or more in open interest.

The reason for this is that you want to have a very liquid market so you can get in and get out of the market with as little slippage as possible. You want a lot of players in the game. If there is very little volume, this means that there are not many people trading that market and it would be difficult to buy or sell a contract and/or to get a decent fill price.

Thinly traded markets also tend to be very volatile and can have huge price swings in a day or so and slippage is even greater. Look at the Palladium chart below. It is a thinly traded market that has huge daily price swings. You can trade these markets if you like, but you must be careful if you do.

I only trade three contract periods; the front month and the next two contract months. I try to be out of a trade before the FND. Strange price swings sometimes take place within the last 14 days of the contract.

Let’s say you are looking at trading Corn as an example. You want to first look at the front month. How much interest is in that month? Then look at the next month out. How much open interest is in that month? A simple rule is to trade the most liquid contract. (Note that contracts, volume and slippage don’t apply to Forex)