The TrendBot EA is a semi-automatic robot that focuses on the money making aspect of trading an opportunity. As you are aware by now, TrendBot excels in sideways and trending markets with lots of pull-backs. Protecting the capital and managing risk is the trader’s job, and this is accomplished through hedging.

Hedging is the act of doing the opposite in order to neutralize the risk. If TrendBot is busy buying in an intermediate uptrend, hedging, entering a sell position of the same size, when the price drops 300 pips will limit the risk from extreme short term drops in the price. Nobody knows how far the market will drop and it definitely can move farther than the money in your account.

Hedging is like insurance, it is intended to protect your capital. There will be hedging costs just like insurance, but it will give you peace of mind and limit your risk. If you don’t hedge then you will risk 100% of your capital. It is that simple!

Hedging is currently unavailable in the U.S. and the F.I.F.O. rule (First In First Out) makes it impossible to run TrendBot EA through a U.S. broker.

The Math

By following the rules of this strategy we are risking a maximum 30% of capital used for each opportunity. We aim to achieve 3-6% per month in profits, and once you have achieved 30% in profits, the opportunity becomes a risk free trade.

Starting Capital: $10,000

Max Risk: $3,000

1 Pip = ~$1 (0.10 lot size) Pip Values

Hedge: 300 pips = $300/lot

Max Position Size: 10 lots

Capital per Lot: $1,000

Capital/Hedge = maximum risk $300/lot or $3,000 total

We have determined 300 pips to be a good hedging level as it is the point where a retracement becomes larger than normal, and it is an acceptable risk if we get caught in a bad opportunity.

Your Warning: You must place a Stop Loss on every hedge. If you don’t, you might find yourself with hedges in the market way below the market as it runs towards your target.

The Good News: When you hedge and the market continues to drop 100+ pips from your hedge entry, you can change your stop loss from -30 pips to +0-5 pips. Then, when the price pushes back up and takes out your hedge, your insurance is free!

Method

There are different options for implementing hedging. One option is to preset the hedge orders. Another option is to apply technical analysis and enter hedges based on the price movement, or a combination of the 2 will ensure hedging is accomplished.

Presetting Orders

The simplest way to manage hedging is to preset your orders for every open position in the market. For example, if you bought 0.10 EURUSD at 1.11400, set up a Sell Stop order for 0.10 EURUSD at a price of 1.184000, 300 pips below your buy position. Then, set your exit order which is a Buy Stop order 30 pips above your entry at 1.18700.

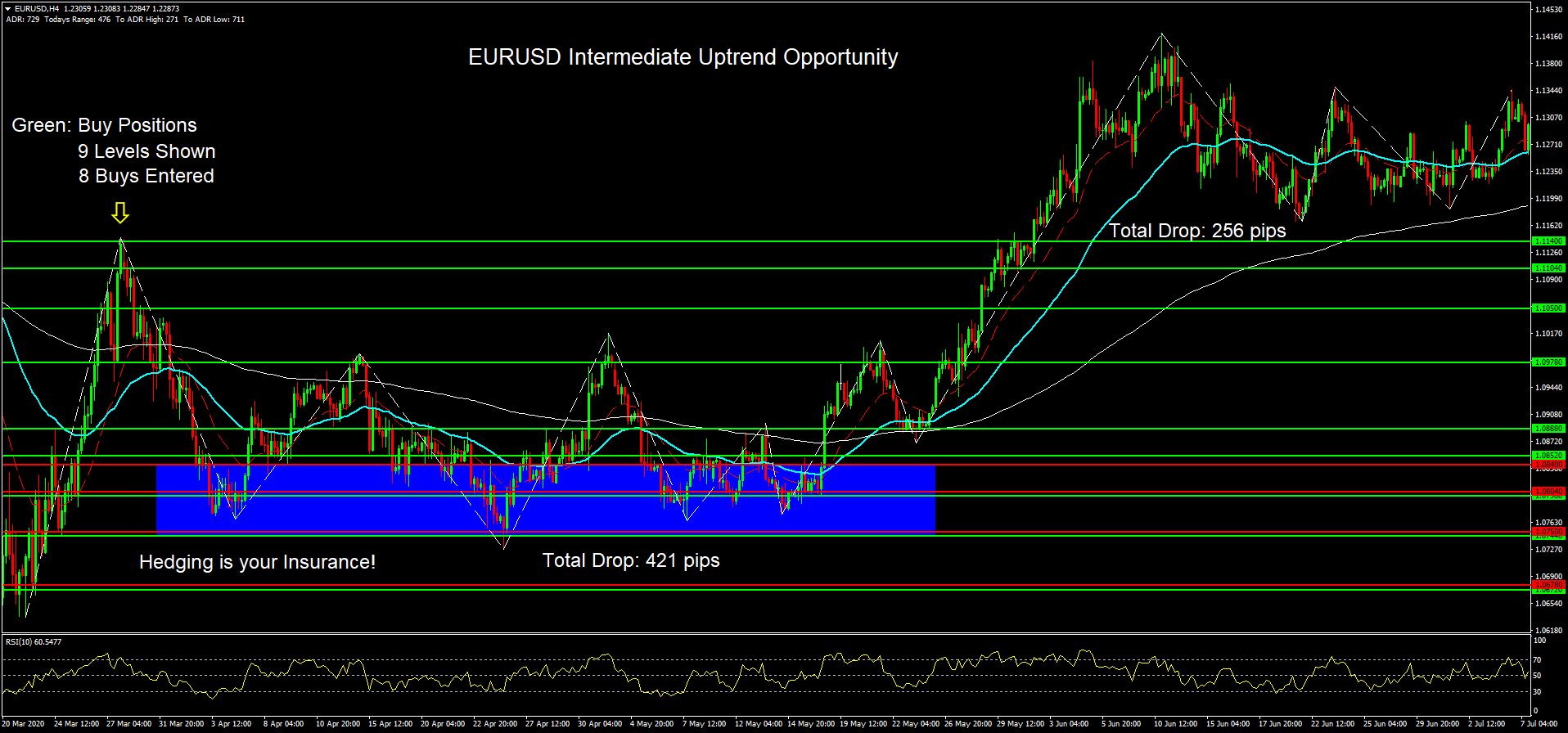

In the EURUSD Buy Opportunity below, during the retracement starting from the down arrow, there were 8 positions entered into the market as shown by the green lines. The red lines show where the top 3 positions needed to be hedged.

As you can see by the blue area, the market was forming a support area, and hedging in this area would have produced quite a few hedging losses. Remember, if your hedge is stopped out you must re-enter it as the market can still continue to push down.

There is flexibility with hedging. If the maximum position size is 10 lots, then you want your AVERAGE hedge price to be 300 pips per lot. Therefore, it is a good idea to adjust your hedges so they are not in the middle of a support area. For example, say your first and second hedges are 400 pips from the buy entry, then you simply make up the 200 pips by hedging other positions early. If you have trouble getting back to an average of 300 pips per lot then you can always reduce your number of buys to 9 lots max and regain 300 pips.

Apply Technical Analysis

Applying any number of technical tools really goes a long way to increasing your ability to hedge this strategy, usually. Nothing is 100% but we are talking about being active as opposed to being passive. If markets moved straight then presetting hedges would suffice, but markets swing up and down sometimes smoothly and sometimes violently. Tools such as trend lines, moving averages, indicators, etc. can all work in your favor for reading the price action and getting an idea of the market structure and potential direction.

When applying technical analysis to determine your hedge points we recommend using the price for setting your stop loss as well. Being active will allow you to protect your capital and possibly come out of a retracement with a profit instead of hedging losses.

Trend Lines

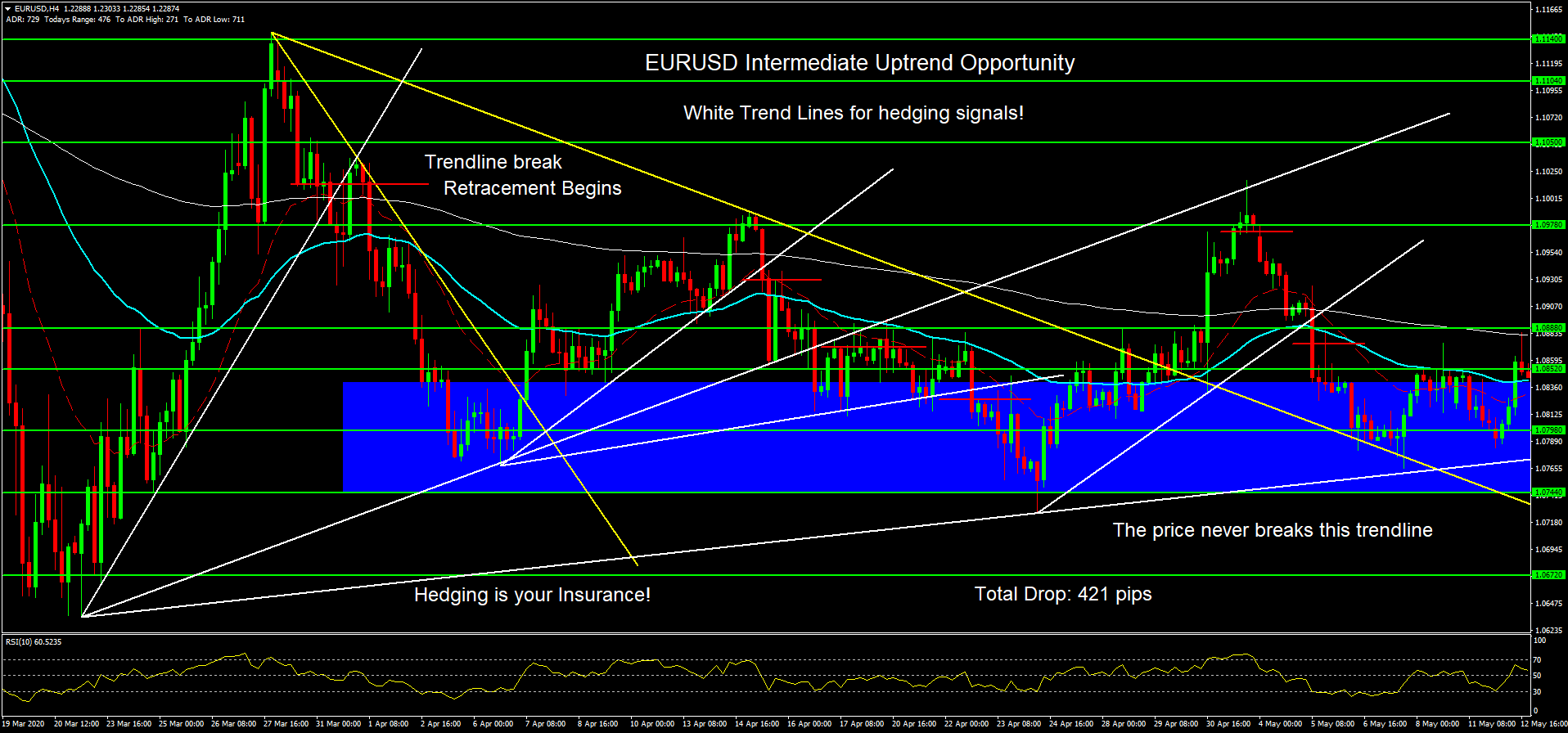

Short term trend lines can be used to signal when the price is reversing and allow you to hedge in good spots, sometimes even earlier than 300 pips. In the example below, the white trend lines provided the hedge signals once broken, and the yellow trend lines showed when the push down ended, and the market was ready to push back up.

Moving Averages

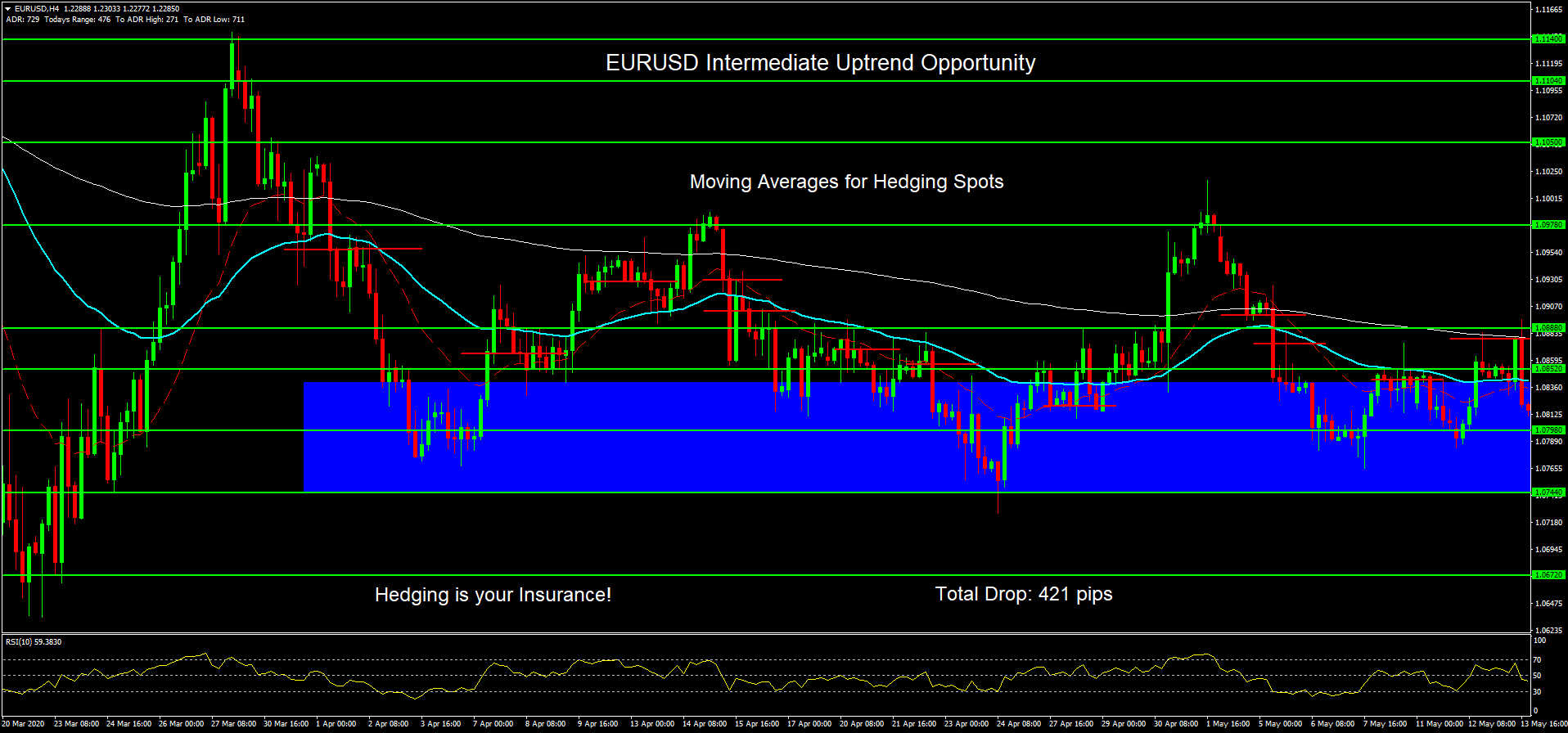

Moving averages can also be used for hedge signals. They provide dynamic support and resistance when the market is trending, but don’t get respected much in sideways market such as in this example.

Indicators

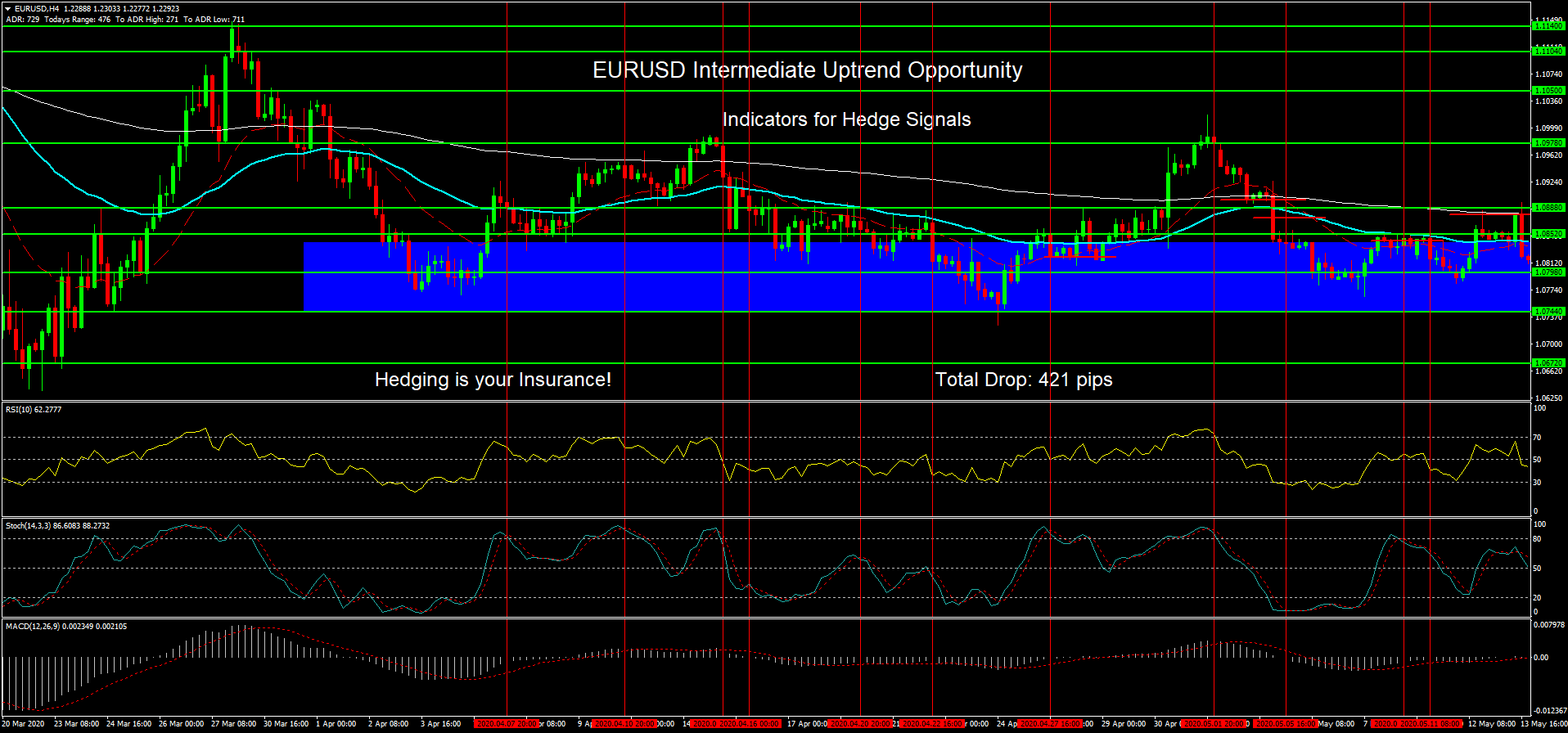

A momentum indicator can also provide hedge signals. When the indicator moves to the overbought area or crossed above the 50 line and then reversed gives a signal to hedge. Some momentum indicators that work well are the RSI, Stochastics, or the MACD which is based around a 0 line with the indicator moving between positive and negative readings. Practice with different indicators to determine which one works best for you.

Using a combination of these different tools will allow you to analyze the price and hedge accordingly. The key is not to panic or get too aggressive with hedging. The TrendBot will continue to trade through these sideways ranges as you can see by the number of times it passes through the green lines on the chart.

Trader’s Mindset: Acceptance of Risk

You must learn to accept risk if you want to be a successful trader. Easy, I accept it! Well, it’s not that easy and is the root cause of fear and pain in trading. It is one thing to say it, and a completely different thing to live it. The reason trading is so difficult for most is that you have to do what is uncomfortable. Namely, have confidence in yourself and your edge while facing uncertainty in the market day in and day out. The only way to develop those skills is through hard work. Are you ready to put in the work and commitment to change?